An asset turnover ratio also called the total asset turnover ratio is an efficiency ratio that compares the value of a companys sales income to its total asset value. Based on the given figures the fixed asset turnover ratio for the year is 951 meaning that for every one dollar invested in fixed assets a return of almost ten dollars is.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Current Asset Turnover Year 2 3854 766 503.

. Net sales Total assets. This efficiency ratio compares net sales income statement to fixed. Inventory turnover is a ratio showing how many times a companys inventory is sold and replaced over a period of time.

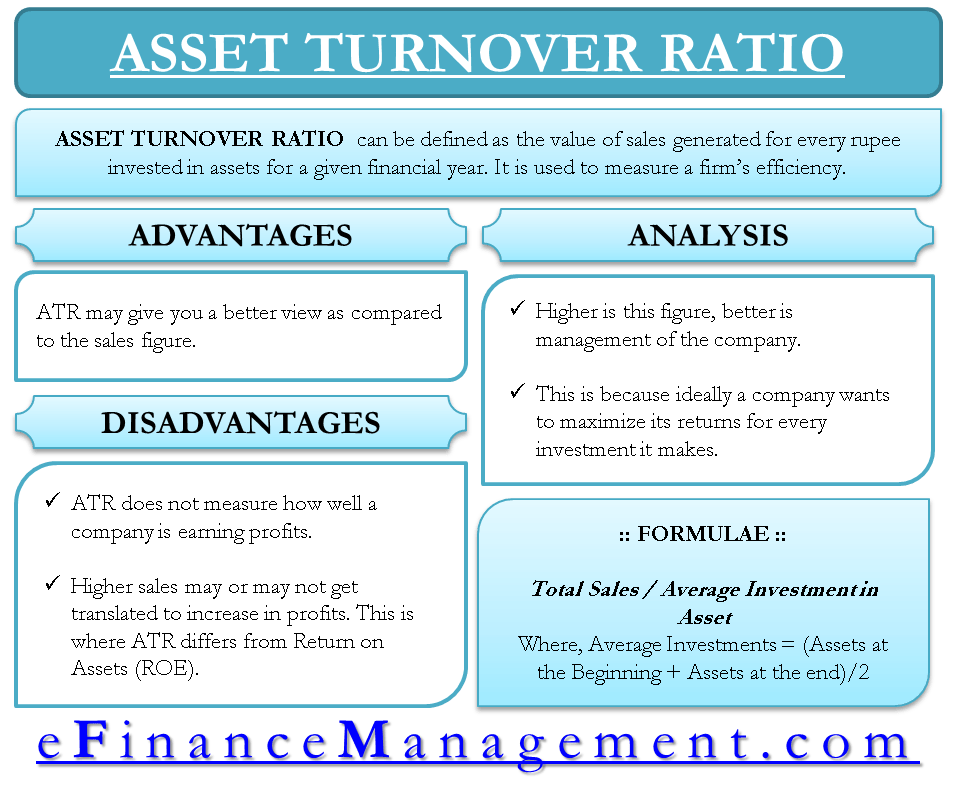

The calculation is as follows. The fixed asset turnover ratio FAT is in general used by analysts to measure operating performance. The asset turnover ratio is a measurement that shows how efficiently a company is using its owned resources to generate revenue or sales.

Formula for Asset Turnover Ratio Asset Turnover Net Sales Revenue Average Total Assets Example of Asset Turnover. The asset turnover ratio is calculated by dividing net sales by average total assets. Year 2 witnessed a slight decrease of firms current asset turnover ratio from 510 to 503 comparing to year 1.

Lower ratios mean that the company isnt using its assets efficiently and most likely have. Unlike other turnover ratios like the inventory turnover ratio the asset turnover ratio does not calculate how many times assets are sold. This ratio tells you how many dollars of revenue the value your company gets relative to the amount invested in total assets not just your fixed assets.

Total Sales Annual sales total. Beginning Assets Assets at start of year. What Does Total Asset Turnover Ratio Mean.

For the fiscal year ended December 31. Divide each years sales by its total assets to calculate each years asset turnover ratio. The ratio is calculated by dividing a companys net sales for a specific period by the average total assets the company held over the same period.

The formula for total asset turnover can be derived from information on an entitys income statement and balance sheet. Each of the current assets will. Higher turnover ratios mean the company is using its assets more efficiently.

The Asset Turnover Ratio is a metric that measures the efficiency at which a company utilizes its asset base to generate sales. If you can cut. In this example divide 18 billion by 750 million to get an asset turnover ratio of 24 in the.

The asset turnover ratio. The days in the period can then be divided by the. The ratio compares the companys gross.

Asset Turnover Ratio Formula Meaning Example And Interpretation

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

0 Comments